TECHNOLOGY

Why Connected Tools Are Essential for Reducing Operational Risks

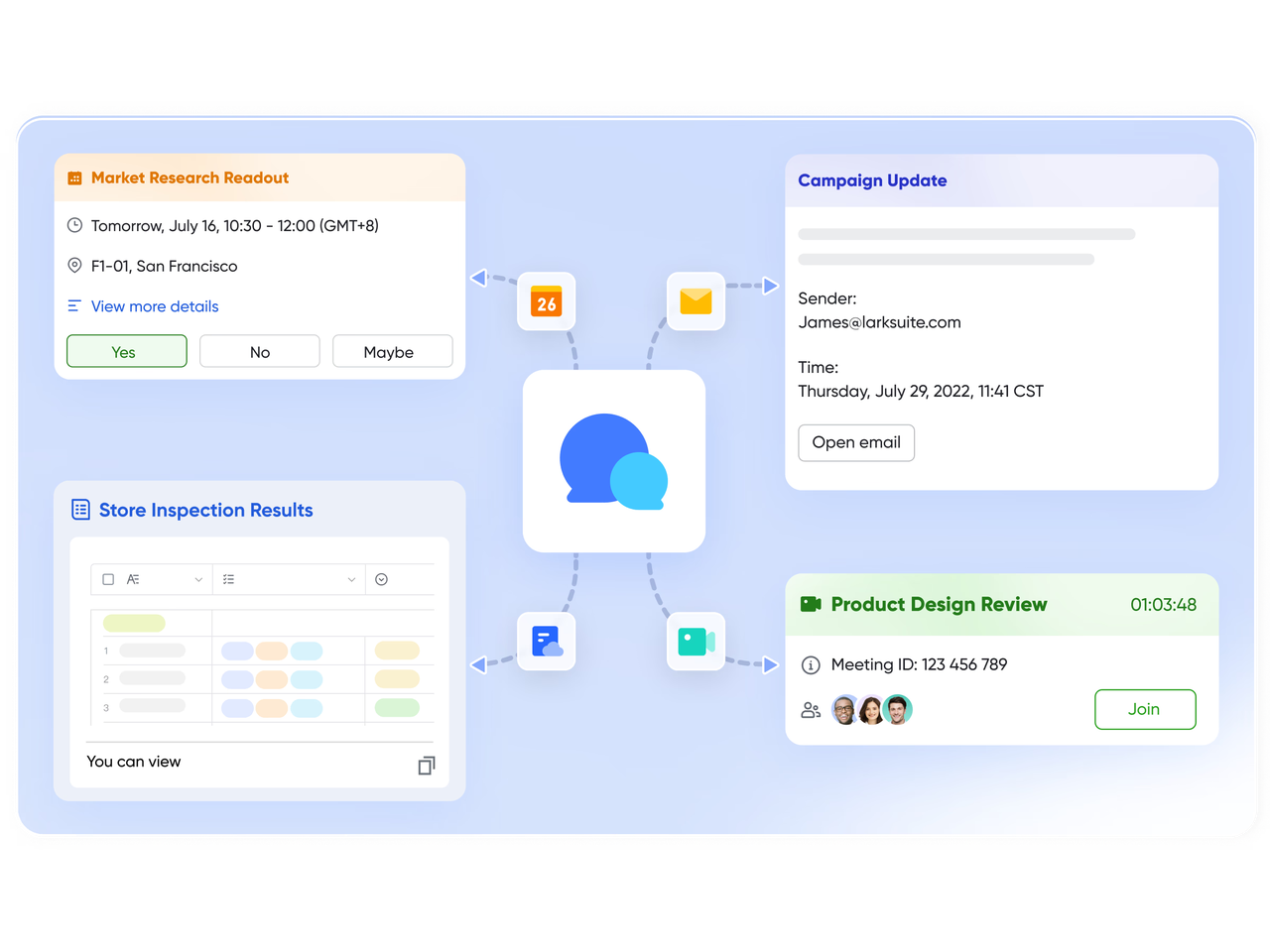

Lark Messenger: reducing risks through clear communication

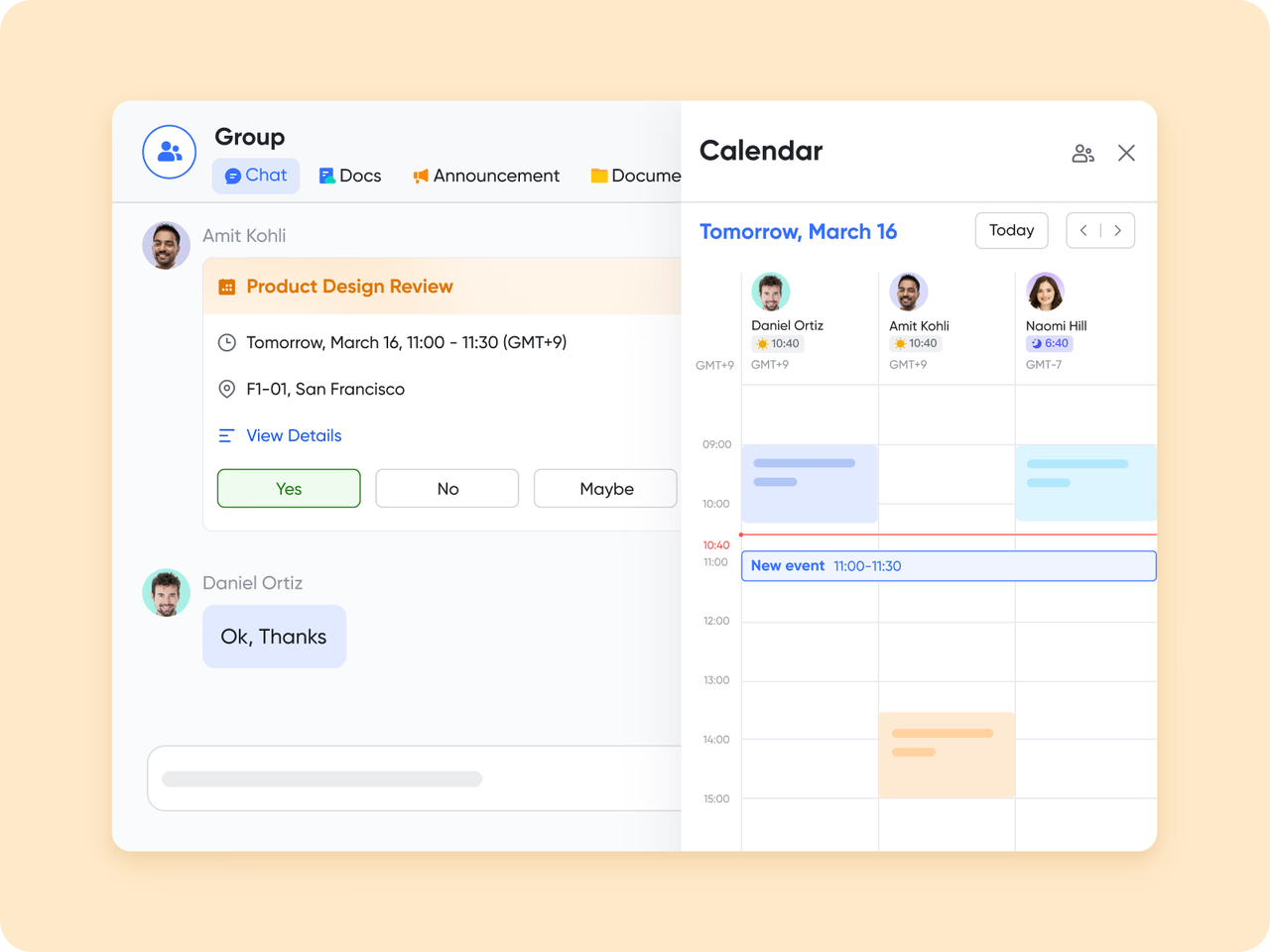

Lark Calendar: preventing scheduling conflicts and missed deadlines

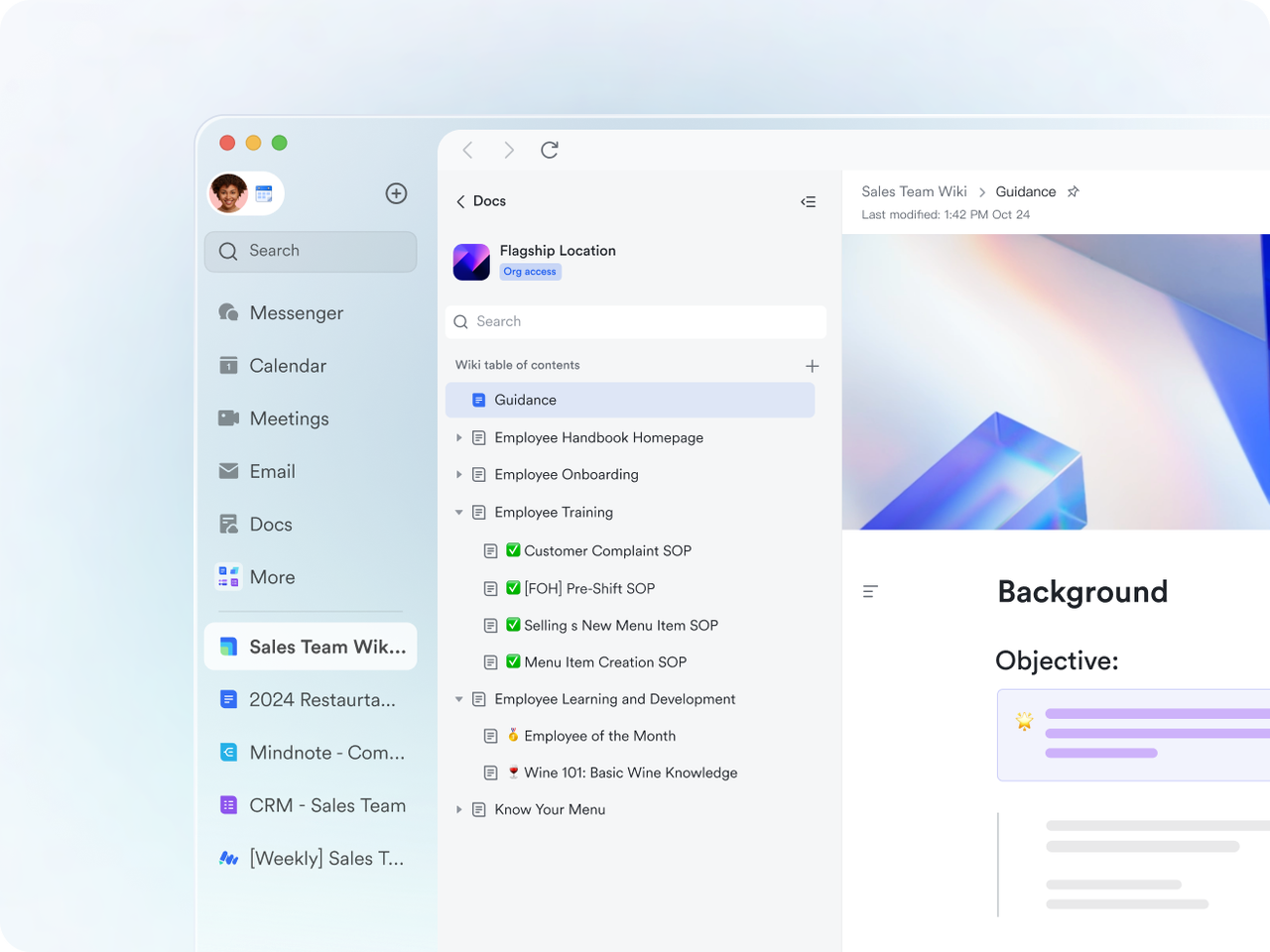

Lark Docs: ensuring alignment through living documents

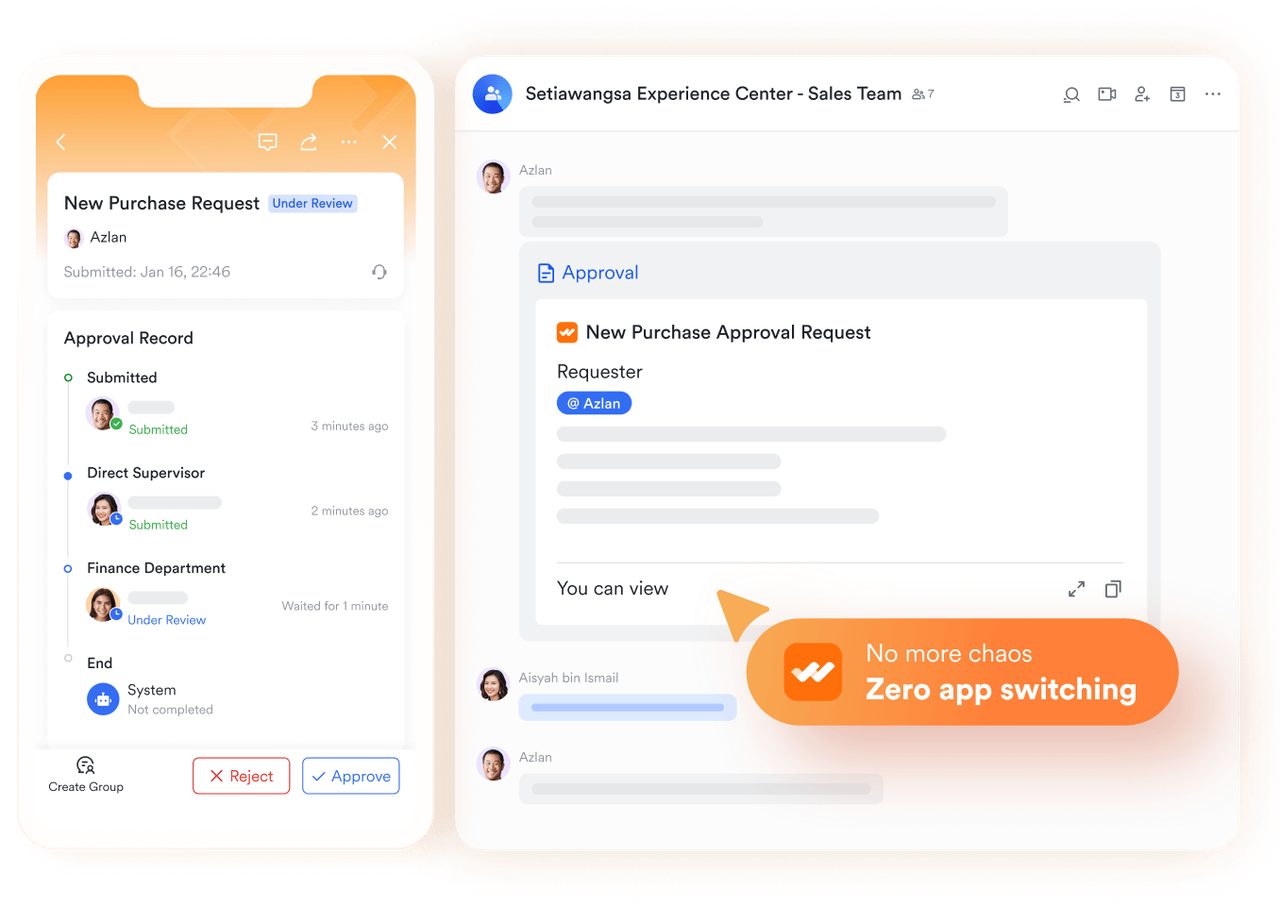

Lark Approval: structured processes that remove bottlenecks

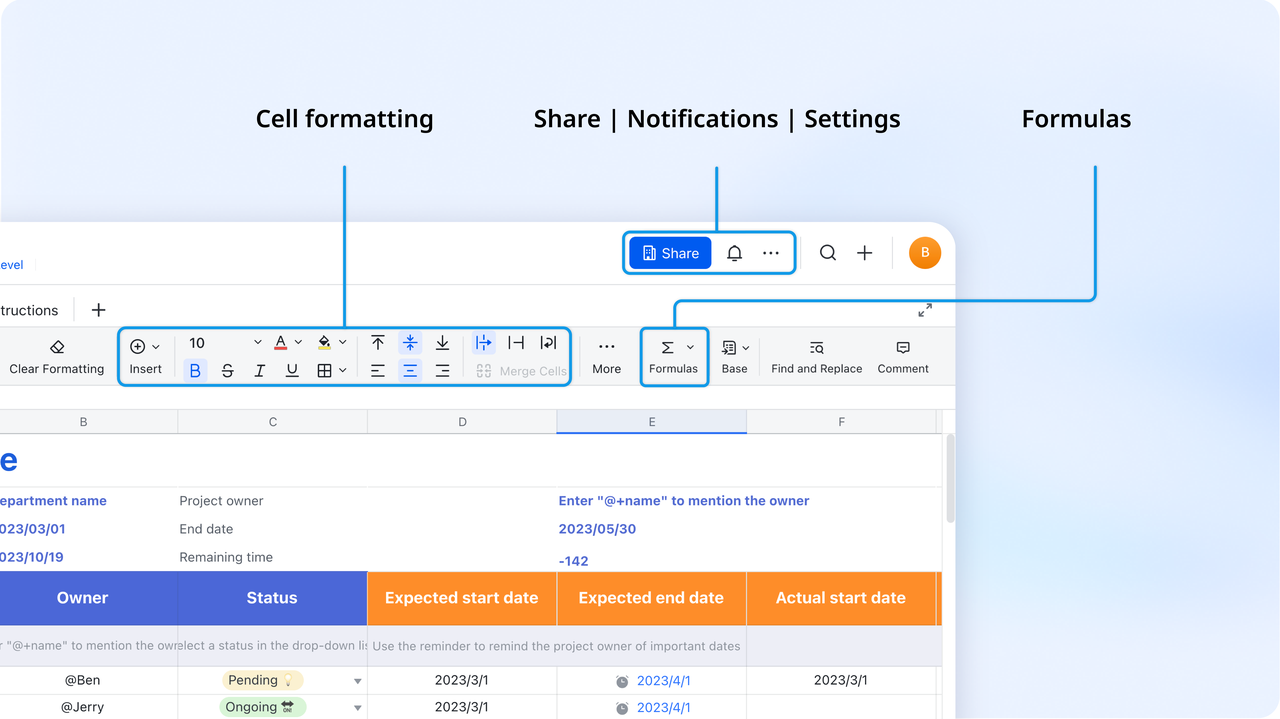

Lark Sheets: visibility that prevents bad decisions

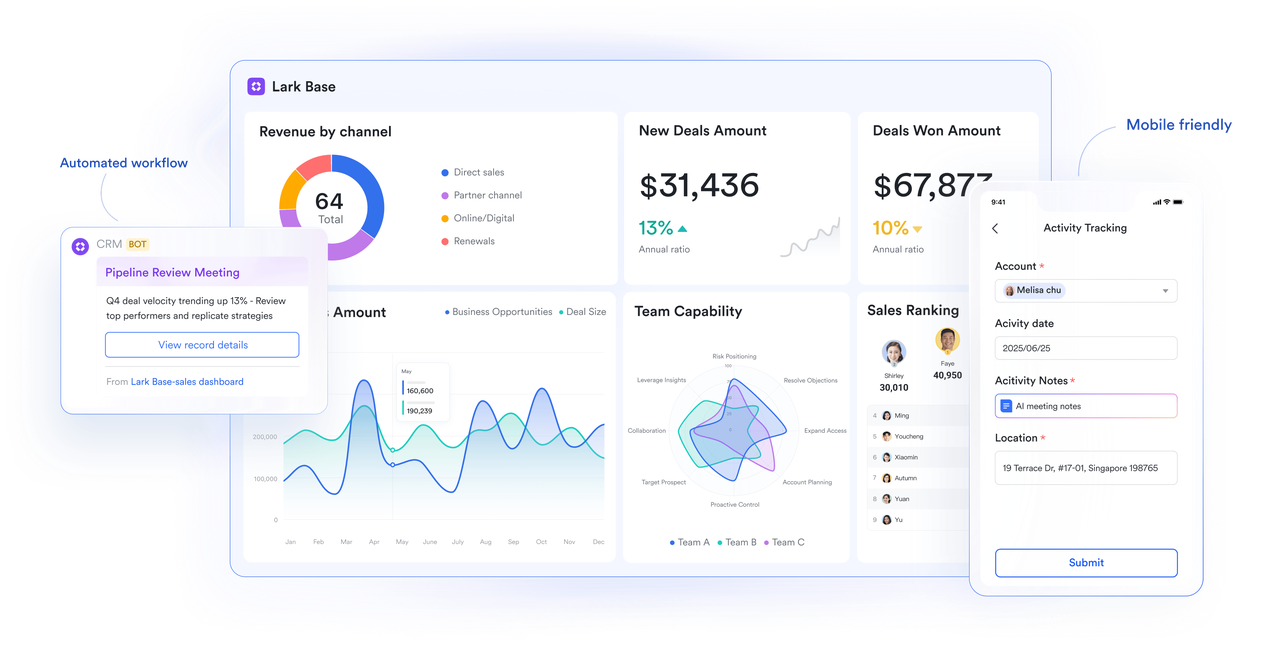

Lark Base: structuring data to control complexity

Conclusion

TECHNOLOGY

Automated Branding for E-commerce: Scaling Product Visuals Across Every Channel

Running an ecommerce operation is frequently a race against time. With inventory management, customer support, and marketing at the top of their to-do list, design consistency can be hard to maintain. But never fear, automated branding is here!

Technology is the key here, so you can easily have a consistent visual identity on all touchpoints and look professional and with it enough to keep the store looking good as it grows (i.e., without having to design every single asset from scratch manually).

The Power of Automated Branding for E-commerce

Picture rolling out a sale on five social media platforms, as well as on your website and in an email newsletter. In the past, that would mean spending days resizing and fiddling with images. Automatic branding is a game-changer by ensuring visual contentis effectively created on the fly on all brand channels.

It’s not just speed; it’s substantial efficiency, in time and in budget. Automation tools do the grunt jobs, rather than hiring a large design team to tackle monotonous tasks. As we like to tell people, our creative automation platform is enabling e-commerce teams to supercharge their visual marketing and decrease production costs and time to market.

Key Statistics on E-commerce Automation

The impact of automation isn’t just theoretical; the numbers back it up. Here is a look at how automation is reshaping the industry:

| Metric | Impact | Source |

| Production Speed | Created 5,000 image/video ads in 2 hours (vs. 5 days manually) | Fortune Business Insights |

| Time Savings | 90% time saved on producing and distributing creatives | Bannerwise / Fortune Business Insights |

| Conversion Rate | 2x more conversions with interactive content vs. passive content | Startups.com |

| Fulfillment Costs | 25% reduction in order fulfillment costs via robotics automation | Amazon / CS-Cart |

Scaling Product Visuals Across Channels

Consistency is the trust currency of e-commerce. If your Instagram ads appear high-end, but your product pages are messy, you lose credibility. DABBA makes sure your fonts, colours, and logos stay locked down, no matter how many versions you create with creative automation.

It saves you from scaling up your workload while burning out your staff. It’s not marketing that leaves you exhausted and puts you to sleep at night, but it never goes anywhere, or a job that gives control and insight over the process through creative automation. You can now run hyper-local campaigns or personalized messages at scale, knowing that your brand identity is protected.

The Role of AI in Enhancing Visuals

The modern day Automation engine is driven by Artificial Intelligence. It can automatically crop photos to different aspect ratios, create lifestyle backgrounds behind plain product shots, and write alternative text for accessibility purposes. Cutting-edge tech like artificial intelligence turbocharges the possibilities of online retail, making it possible to do more with less and keep your storefront looking fresh without expensive photo shoots.

SoSoActive: Boosting User Engagement

Static images are nice, but they don’t tell the whole story. Looking to really catch eyes, many brands are using SoSoActive content. This means interactive content formats such as quizzes, shoppable video, and dynamic polls that require active user participation rather than passive scrolling.

When someone clicks a SoSoActive element, they aren’t browsing; they are contributing. This helps strengthen the bond between you and your brand, drive more time spent on site, and better brand recognition and conversion rates.

Semantic SEO Strategies for E-commerce

Getting ranked on Google is no longer just about finding new ways to stuff keywords into product descriptions. Semantic SEO is all about getting the meaning of a search. It’s the building content that thoroughly answers the user’s questions.

For an e-commerce site, this means your category pages won’t just enumerate all available products; they will lead and assist the buyer. If you’re selling running shoes, semantic SEO is about providing a broad topical coverage, including “best shoe for marathon training” or “how to size a running shoe”, so that search engines can recognize you as an authority within your niche.

Best Practices for Implementing Automated Branding

Ready to get started? Here are three tips to ensure success:

- Prioritize Consistency: Set strict brand guidelines (fonts, hex codes) within your automation tools so no asset goes off-brand.

- Trust the Data: Use A/B testing to see which visual styles perform best, then automate the winning format.

- Update Regularly: Don’t let your automation run on autopilot forever. Refresh your templates seasonally to keep your brand looking current.

Scale Smarter, Not Harder

Branded automation is no longer a nice convenience but more of an essential to modern e-commerce scaling. When you automate the repetitive parts of design and marketing, your team is free to concentrate on strategy and growth. You acquire the ability to be all things to everyone at all times, looking your best on every channel, without spreading yourself so thin you snap.

TECHNOLOGY

VART VR Arcade: Transforming Entertainment with Immersive Technology

The entertainment landscape is evolving faster than ever, driven by rapid advances in immersive technology. Audiences today seek more than passive viewing or traditional gaming—they want to be part of the experience. Virtual reality has emerged as a powerful force redefining how people interact with digital content, and VART VR Arcade is leading this transformation. By combining cutting-edge hardware, immersive content, and commercial-grade reliability, VART is reshaping modern entertainment through next-generation VR experiences, including the rising trend of the vr movie theater and movie theater virtual reality concepts.

The Shift Toward Immersive Entertainment Experiences

Traditional entertainment formats such as cinemas, arcades, and amusement rides are no longer enough to meet growing consumer expectations. Modern audiences crave interactivity, realism, and emotional engagement. Virtual reality fulfills these demands by placing users directly inside digital environments rather than positioning them as passive observers. VART VR Arcade solutions capitalize on this shift by offering immersive attractions that appeal to families, gamers, movie lovers, and tech enthusiasts alike.

What Makes VART VR Arcade a Game Changer

VART VR Arcade systems are designed specifically for commercial use, setting them apart from consumer-grade VR setups. These systems integrate high-resolution VR headsets, motion-enabled seating, advanced tracking technology, and immersive sound systems. The result is a seamless, realistic experience that captivates users from the moment they put on the headset. VART focuses on durability, safety, and ease of operation, making its solutions ideal for malls, theme parks, family entertainment centers, and dedicated VR venues.

The Rise of the VR Movie Theater Concept

One of the most exciting developments in immersive entertainment is the emergence of the vr movie theater. Unlike traditional cinemas, VR movie theaters allow viewers to step inside the story itself. Instead of watching a film on a flat screen, users are surrounded by 360-degree visuals and spatial audio that create a sense of presence. VART VR Arcade enables this new form of storytelling by providing specialized VR theater setups that transform movie watching into an interactive and deeply immersive experience.

Movie Theater Virtual Reality: Redefining Cinema

The concept of movie theater virtual reality is redefining what it means to watch a film. With VR, viewers can experience cinematic content in entirely new ways—exploring scenes, changing perspectives, or feeling as though they are physically present within the narrative. VART’s VR arcade systems support a wide range of cinematic VR content, including animated films, documentaries, educational experiences, and immersive storytelling projects. This innovation opens new revenue streams for cinema operators and creates unique attractions that traditional theaters cannot replicate.

Immersive Technology Behind VART VR Arcade

At the core of VART VR Arcade’s success is its advanced immersive technology. High-performance VR headsets deliver sharp visuals and wide fields of view, while motion platforms synchronize physical movement with on-screen action. Spatial audio enhances realism by making sound feel directional and dynamic. These elements work together to create a fully immersive experience that engages multiple senses, making VR attractions more memorable and impactful than conventional entertainment options.

Diverse Content for Broad Audience Appeal

VART VR Arcade solutions are built around content diversity. In addition to vr movie theater experiences, VART systems support action games, adventure simulations, educational programs, and interactive storytelling. This variety ensures appeal across different age groups and interests. Families can enjoy immersive films together, while younger audiences are drawn to interactive games and simulations. By offering something for everyone, VART helps entertainment venues attract consistent foot traffic and repeat visitors.

Commercial Design and Reliability

Commercial entertainment environments demand equipment that can perform reliably under constant use. VART VR Arcade systems are engineered with industrial-grade components, reinforced structures, and optimized cooling systems. This ensures long-term durability and minimal downtime. For operators, this reliability translates into lower maintenance costs and uninterrupted service, which is essential for maximizing profitability in high-traffic venues.

Operator-Friendly Management Systems

Ease of operation is a key factor in the success of any commercial entertainment solution. VART VR Arcade includes intuitive management software that allows operators to control sessions, monitor system performance, manage content, and adjust pricing. This centralized control reduces the need for technical expertise and streamlines daily operations. For venues running multiple VR stations or a full vr movie theater setup, efficient management tools are crucial for smooth customer flow.

Enhancing Social and Group Experiences

Entertainment is often a shared experience, and VART VR Arcade solutions are designed to support social interaction. Group-based VR experiences, shared virtual environments, and synchronized movie theater virtual reality sessions encourage friends and families to enjoy attractions together. These social elements increase engagement and create memorable moments that drive word-of-mouth marketing and repeat visits.

Safety, Comfort, and Accessibility

Safety and comfort are top priorities in immersive VR environments. VART designs its systems with ergonomic seating, secure harnesses, and carefully calibrated motion to ensure a comfortable experience for users of various ages and experience levels. Clear instructions and user-friendly interfaces make VR attractions accessible to first-time users, expanding the potential audience and improving overall customer satisfaction.

Revenue Opportunities for Entertainment Venues

From a business perspective, VART VR Arcade solutions offer strong revenue potential. Immersive attractions such as vr movie theater experiences command premium pricing due to their novelty and emotional impact. Short session durations allow high customer turnover, while repeatable content encourages return visits. Additionally, VR attractions increase overall dwell time, benefiting surrounding businesses such as food courts, retail shops, and traditional cinemas.

Customization and Scalability for Growth

Every entertainment venue has unique space and business requirements. VART VR Arcade systems are highly customizable and scalable, allowing operators to start with a small setup and expand over time. Whether integrating a movie theater virtual reality experience into an existing cinema or launching a full-scale VR arcade, VART solutions can grow alongside the business, protecting long-term investment.

Why VART VR Arcade Represents the Future of Entertainment

As immersive technology continues to advance, virtual reality is set to play an increasingly important role in entertainment. VART VR Arcade stands out by delivering commercial-ready solutions that combine innovation, reliability, and engaging content. By embracing concepts like vr movie theater experiences and interactive storytelling, VART is pushing the boundaries of what entertainment can be.

Conclusion

VART VR Arcade: Transforming Entertainment with Immersive Technology represents a bold step into the future of experiential entertainment. By blending advanced VR systems with innovative concepts such as the vr movie theater and movie theater virtual reality, VART enables entertainment venues to captivate modern audiences and stay ahead of industry trends. For businesses seeking to offer unforgettable experiences, drive revenue growth, and redefine how stories are told and experienced, VART VR Arcade provides a powerful and future-ready solution.

TECHNOLOGY

Commercial VR Arcade Machines by VART Arcade for Profitable Venues

The global entertainment industry is rapidly shifting toward immersive, technology-driven attractions that deliver unforgettable experiences and strong revenue potential. Traditional arcade games and rides are no longer enough to satisfy modern audiences who crave excitement, realism, and interaction. This is where virtual reality has become a game-changer. VART Arcade stands at the forefront of this transformation, offering advanced commercial VR arcade machines designed specifically for profitable entertainment venues. From thrilling 9d vr cinema experiences to high-speed vr car racing, VART Arcade provides solutions that maximize engagement and return on investment.

The Rise of Commercial VR in Entertainment Venues

Virtual reality has evolved from a niche technology into a mainstream attraction embraced by arcades, shopping malls, theme parks, family entertainment centers, and gaming lounges. Customers are drawn to VR because it offers something traditional games cannot—full immersion. Instead of watching a screen, players become part of the action, surrounded by realistic visuals, motion, and sound.

For venue owners, VR attractions represent an opportunity to stand out in a competitive market. Commercial VR machines attract new customers, increase dwell time, and encourage repeat visits. VART Arcade understands these business needs and designs its products to deliver both entertainment value and consistent profitability.

Introducing VART Arcade Commercial VR Solutions

VART Arcade is a leading manufacturer and supplier of commercial VR arcade machines, known for innovation, quality, and reliability. The company focuses on creating VR equipment that is visually impressive, technically advanced, and built for long-term commercial use.

What makes VART Arcade unique is its comprehensive approach. Instead of offering standalone machines, the company provides complete VR solutions that include hardware, immersive content, and operational support. This ensures that entertainment venues can confidently invest in VR technology without worrying about complexity or maintenance challenges.

High-Performance VR Arcade Machines for Commercial Use

Commercial environments require equipment that can handle continuous operation and high customer traffic. VART Arcade’s VR arcade machines are built using durable materials and industrial-grade components, making them ideal for busy venues.

These machines feature advanced motion systems, high-resolution VR headsets, and responsive control technology. Whether it’s a compact simulator or a multi-seat attraction, each unit is designed to deliver smooth performance and an unforgettable experience. This level of quality ensures customer satisfaction while minimizing downtime for operators.

9D VR Cinema: A Powerful Crowd-Puller

One of the most popular attractions offered by VART Arcade is the 9d VR cinema, a multi-sensory experience that goes beyond traditional VR. Unlike standard virtual reality setups, 9D VR cinema combines immersive visuals with motion seats, surround sound, wind, vibration, and other physical effects.

This combination creates an intense and realistic experience that appeals to a wide audience, including families and first-time VR users. For venue owners, 9d vr cinema installations are highly profitable due to their ability to accommodate multiple users simultaneously and deliver short, repeatable sessions. This high throughput makes them ideal for malls, amusement centers, and theme parks.

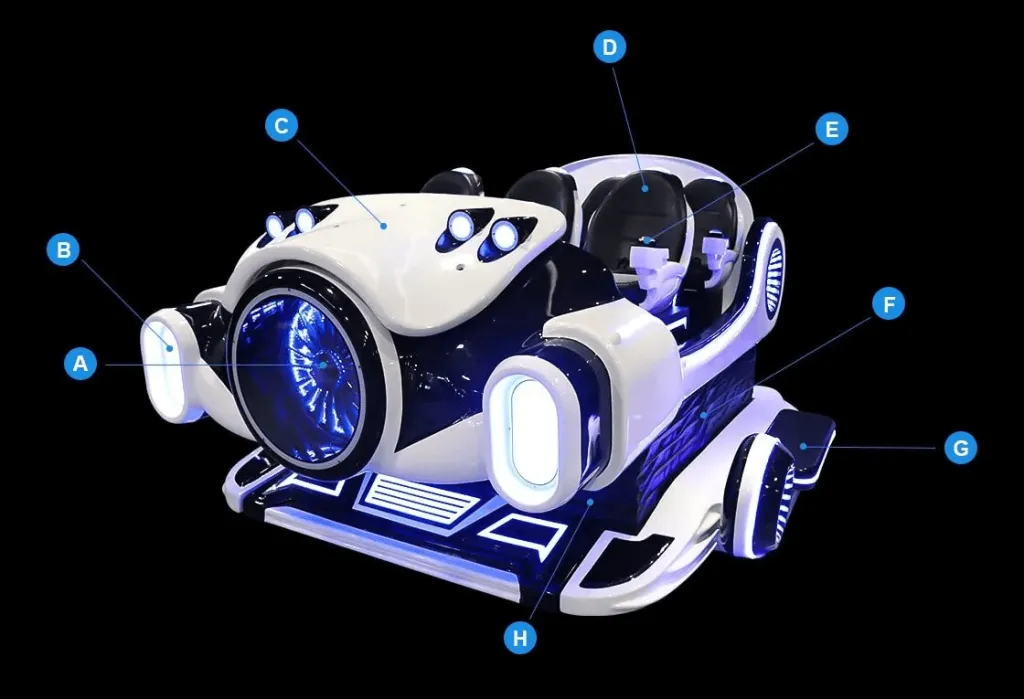

VR Car Racing: Speed, Competition, and Excitement

Another standout attraction from VART Arcade is vr car racing, which delivers high-speed thrills and competitive gameplay. Racing simulators are universally appealing, attracting both casual players and serious gaming enthusiasts.

VART Arcade’s vr car racing machines feature realistic steering wheels, pedals, and motion platforms that simulate acceleration, braking, and cornering. Combined with immersive VR visuals, players feel as though they are driving real race cars on professional tracks. This realism enhances engagement and encourages players to return for rematches, tournaments, and improved lap times.

Maximizing Profitability with VR Attractions

One of the main reasons venue owners invest in VART Arcade VR machines is their strong revenue potential. VR attractions typically generate higher earnings per square meter than traditional arcade games. Customers are willing to pay premium prices for immersive experiences like 9d vr cinema and vr car racing.

Additionally, VR machines require less space compared to large mechanical rides, making them suitable for both small and large venues. Their modular design allows operators to scale their offerings gradually, adding more machines as demand grows.

Designed for a Wide Range of Venues

VART Arcade’s commercial VR machines are versatile and adaptable to various entertainment environments. They are commonly used in:

- VR arcades and gaming lounges

- Shopping malls and commercial centers

- Theme parks and amusement parks

- Family entertainment centers

- Tourist attractions and event spaces

This flexibility makes VART Arcade a reliable partner for businesses at different stages, whether launching a new venue or upgrading existing attractions.

User-Friendly Operation and Safety

Ease of operation is critical for commercial success. VART Arcade designs its VR machines with simple interfaces that allow staff to manage sessions efficiently. Clear instructions and intuitive controls ensure smooth operation even during peak hours.

Safety is equally important. All machines are equipped with secure seating, stable motion platforms, and reliable restraint systems. This ensures that customers can enjoy intense experiences like vr car racing and 9d vr cinema with complete confidence, while operators reduce liability risks.

Customization and Branding Opportunities

To help venues stand out, VART Arcade offers customization options for its VR machines. Operators can choose custom colors, designs, and branded content to match their venue’s theme or corporate identity.

Customized VR attractions not only enhance visual appeal but also strengthen brand recognition. A uniquely branded 9d vr cinema or vr car racing simulator becomes a signature attraction that customers associate exclusively with your venue.

Global Support and Long-Term Partnership

VART Arcade supports clients worldwide with professional consultation, installation guidance, and after-sales service. Their experienced team helps venue owners select the right machines, plan layouts, and optimize space usage for maximum profitability.

After installation, ongoing technical support and content updates ensure machines remain up to date and operational. This long-term partnership approach allows operators to focus on growing their business while delivering consistently high-quality VR experiences.

Why Choose VART Arcade for Commercial VR Machines

Choosing the right VR equipment provider can determine the success of your entertainment venue. VART Arcade stands out due to its commitment to innovation, durability, and customer satisfaction. Their commercial VR arcade machines are designed to meet the demands of modern audiences while delivering strong financial returns.

With proven attractions like 9d vr cinema and vr car racing, VART Arcade helps venues stay competitive in an industry where immersive experiences drive customer loyalty and revenue growth.

Conclusion

Virtual reality has become a cornerstone of profitable entertainment venues, offering immersive experiences that attract, engage, and retain customers. Commercial VR Arcade Machines by VART Arcade for Profitable Venues represent a smart investment for businesses seeking long-term growth and differentiation.

By combining advanced technology, exciting attractions such as 9d vr cinema and vr car racing, and reliable global support, VART Arcade empowers venue owners to deliver unforgettable experiences while maximizing profitability. As the demand for immersive entertainment continues to rise, partnering with VART Arcade ensures your venue remains innovative, competitive, and financially successful.

-

Cast9 months ago

Cast9 months agoRico Rodriguez

-

Episode Guide9 months ago

Episode Guide9 months agoHalloween episodes

-

Cast9 months ago

Cast9 months agoCast

-

Guest Star9 months ago

Guest Star9 months agoValentine’s Day episodes

-

Cast9 months ago

Cast9 months agoSarah Hyland

-

Cast9 months ago

Cast9 months agoWho is your favourite character?

-

Guest Star9 months ago

Guest Star9 months agoGuest Star: Khamani Griffin

-

Episode Guide9 months ago

Episode Guide9 months agoEpisode Guide : Season 1